Canadian real estate markets are fully in a downturn and things are going to get worse before they get better. This week, Canada’s two major real estate markets reported falling home prices and sales for July. It comes as more households expect home prices to fall than rise, which hasn’t been the case in a very long time. To add another squirt of gas on this dumpster fire, BMO Capital Markets reminds us the last rate hike wasn’t even a full month ago, so it has yet to be fully reflected in the data.

Canadian Home Sales Are Falling Very Quickly

Toronto and Vancouver real estate markets tend to lead being the big two, and the picture isn’t great. Both cities have seen a sharp drop in home sales, with Toronto down 47% last month, and Vancouver 43% lower. Inventory levels have only made minor improvements, but falling sales has “balanced” the market.

Home Prices In Toronto and Vancouver Cratered Last Month

Home prices in both of those cities also declined sharply. The benchmark price of a home across Greater Toronto fell $47,500 in July. Over in Vancouver it fell a smaller-but-still-large $28,500 over the same period. Fast falling Southern Ontario, in the areas around Toronto, are seeing the most rapid price drops warns BMO.

“Prices continued to fall in both markets in the month, with parts of Southern Ontario beyond the GTA still looking like the hardest hit,” said Robert Kavcic, a senior economist at BMO.

The bank warned the price drops are only getting started, with the last rate hike not fully priced in at market. “Recall that the BoC’s 100-bp hammer blow came mid-month, so more weakness lies ahead,” he said.

More Canadians See Home Prices Falling Than Rising

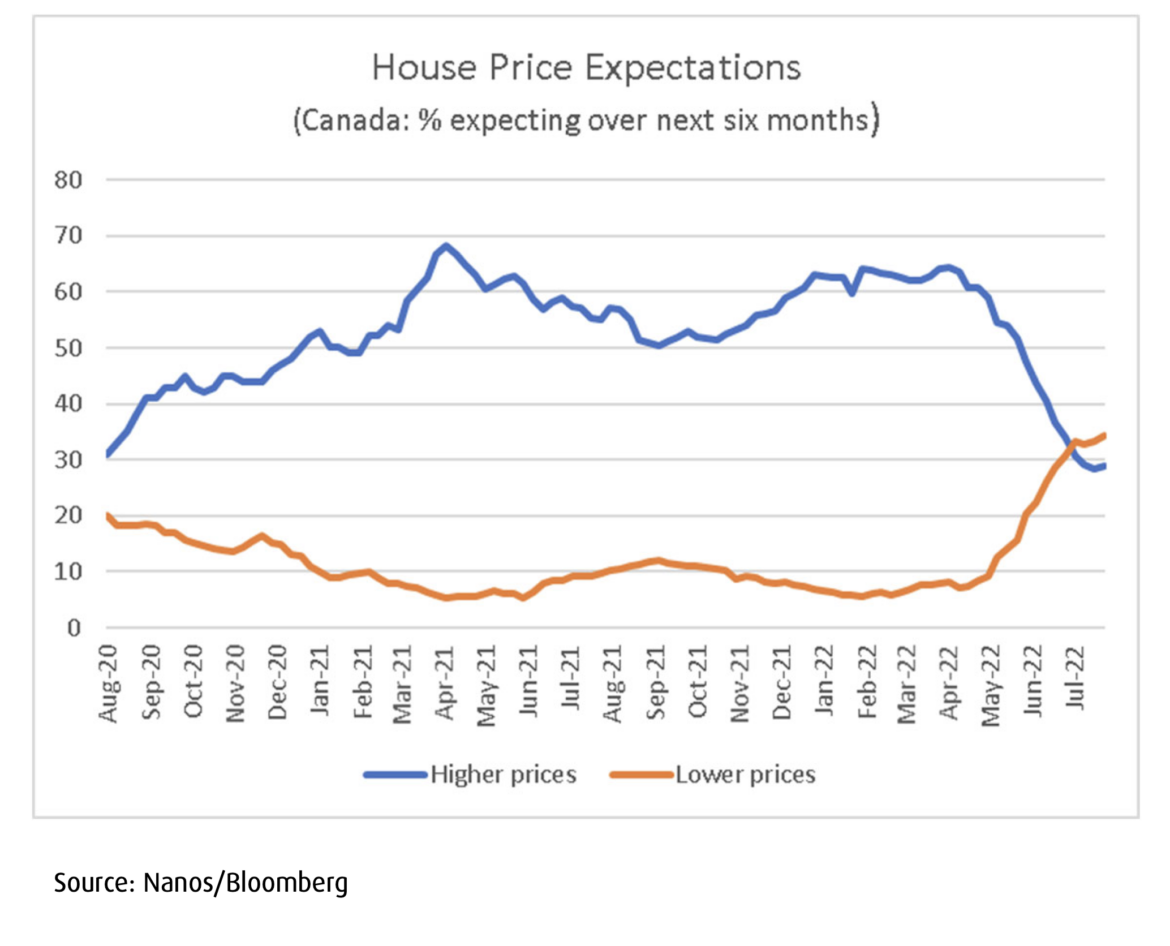

At first the market just rolled with the negative indicators, but households are now taking note of the issue. “Notably, more Canadians now expect home prices to fall than rise over the coming months, a sudden turn from the raging self-reinforcing optimism seen through 2021,” explains Kavcic.

Just a few months ago, it was almost impossible to find someone who thought prices were going to fall. Now more people see prices falling over the next six months than see them rising. “The reality that Q1 pricing is long gone is now setting in for Canadians, as market psychology has turned dramatically,” he says.