Canada’s second largest bank sees lower home prices in your future — as long as you’re in BC or Ontario. TD Economics updated its price forecast following its downward revision on home sales. Economists at the bank now see an “unprecedented” drop for home prices, largely concentrated in more expensive markets. Even with the decline they don’t see all of the price growth seen since 2020-rate cuts, rolling back.

Canadian Real Estate Prices Forecast To Fall 25%

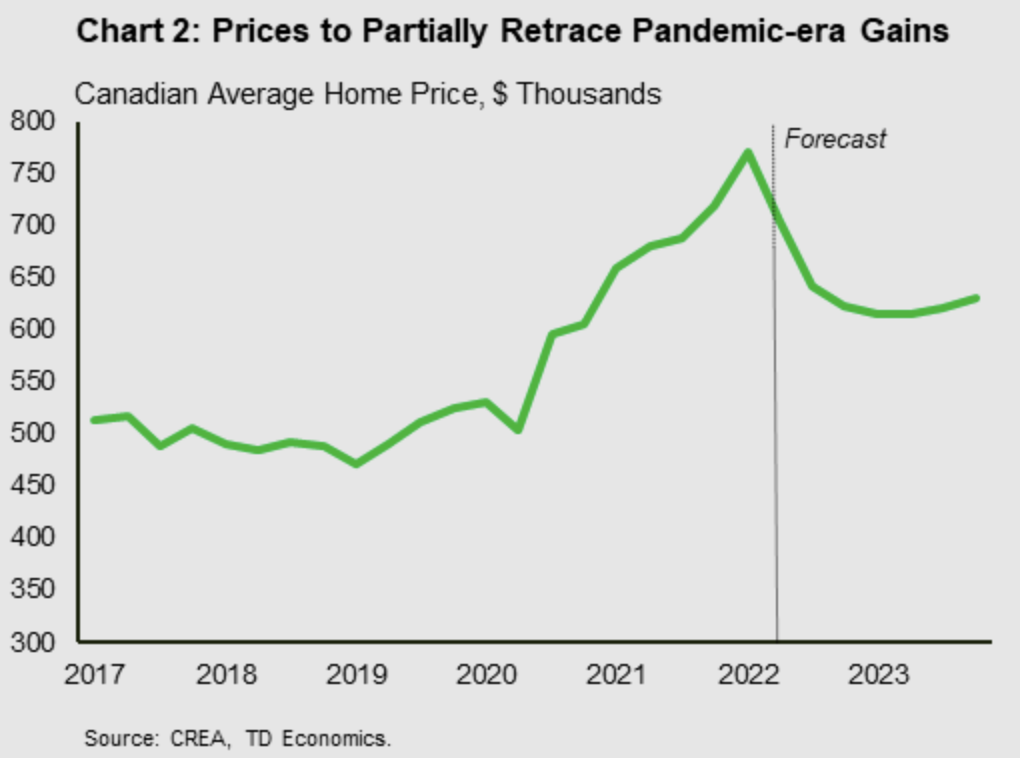

TD is calling a sharp drop for Canadian home prices after the huge pandemic run-up. Their forecast shows home prices falling up to 25% in their base case, from the peak (Q1 2022) to trough (Q2 2023). Unlike the 2017-2018 correction, the bank sees price declines extending to condo apartments as well.

It’s a substantial drop in home prices but not enough to correct the run up following 2020 rate cuts.

“Our forecasted decline in national home prices would only partially retrace the 46% runup over the course of the pandemic,” explained Rishi Sondhi, an economist at the bank.

The largest price drop in history doesn’t wipe out the price increase over the past two years, which says a lot. Running the numbers, that works out to retaining around 10% of gains over three years, roughly the return of target inflation. After a year of elevated inflation, some markets will be lower in real terms.

An “Unprecedented Decline,” But It’s Just Recalibration

Canada has never experienced a price correction this significant, but it won’t be a violent market event. “Our projected price drop represents an unprecedented decline (at least from the late 80’s onwards, when the data began). However, it follows an equally unprecedented runup during the pandemic,” said Sondhi.

Consequently, the market calls it a “recalibration,” referring to the impact in prices due to financing. It seems like an apt description of their forecast, since they don’t see prices returning to the all-time high in the medium-term. A higher cost of financing is expected to throttle home prices going forward.

Canada’s Real Estate Correction To Be Largely A BC & Ontario Story

Looking at national numbers tells us more about the economic impact than prices. Most of the price correction will be concentrated in BC and Ontario, according to Sondhi.

They expect only small spillovers into other regions like the Prairies and Atlantic Canada. Those markets are priced significantly lower and thus less sensitive to interest rate hikes.

TD is the latest bank to call falling home prices after the huge run-up over the past two years. None of them thus far expect home prices to rollback the entire gain, and none see a significant recession. However, some have explained the slow recovery back to the all-time high will allow some relief on affordability as wages catch up.